With the State of Florida enacting a mandatory stay home order in effect as of 12:01 AM, Friday morning, we have been speaking with many landlords and tenants regarding what rights they have during this trying time. The coronavirus outbreak has brought many business issues to light.

On one hand, many businesses have shut down during this time, leaving many tenants without the income source they survive on.

These tenants want to know whether they are at risk of being kicked on the street. On the other hand, landlords are still required to pay any mortgages and other expenses that they owe on the house. Many landlords cannot afford to keep their rental houses without the income they generate. What has the State of Florida said?

Attempts to Stop Coronvirus Evictions

While many politicians would like to halt evictions and have urged the Governor to impose a statewide moratorium on evictions, as of today the State of Florida has not officially issued any such order. Currently, each county is at the discretion to enter their own orders restricting court access and filings.

For example, Seminole, Brevard, and Osceola counties have suspended evictions until April 15. Orange County has suspended evictions through April 17. Without a statewide order, you need to be aware of what orders have been passed in the county you reside in.

Meanwhile, the Florida Supreme Court has issued the following Administrative Order, “given the exigencies of the public health emergency, the requirement in Florida Rule of Civil Procedure 1.580(a) for the clerk to issue a writ of possession “forthwith” shall be suspended through the close of business on Friday, April 17, 2020, or as provided by subsequent order.” https://www.floridasupremecourt.org/content/download/632431/7186205/AOSC20-17.pdf.

What this means is that the State of Florida is not currently requiring counties to follow the eviction process under the Florida Statutes. However, this order only suspends the requirementfor a Clerk of Court to issue the Writ of Possession, it does not suspend or prohibit a county’s ability to enter such a writ.

Without a State ordered mandate, each county is left to decide what is best for their residents. If you are a tenant, should you be worried about being evicted if you are unable to pay the rent during the COVID-19 scare? Likely not, but until the State of Florida puts forth a statewide mandate, it is dependent on the county you live in and there is not a set answer at this time.

What To Do About Rent During The Coronavirus Pandemic

Even though your landlord may not be able to evict you at this time, that does not necessarily mean you will not be liable for the rent payment during this period. It is going to be interesting to see how this plays out from a landlord-tenant perspective because a situation like this has never occurred during our lifetimes. Most likely the tenant will be responsible for the missed rent because the relationship is governed by the lease between the parties.

One question that is raised is whether the landlord will be able to file for eviction immediately after the virus threat is over, or whether the tenant will have a period of leniency in which to make payments to the landlord for the back rent. Without a steady source of income, many tenants will not be able to make a lump-sum payment of past due rent, and many tenants may not be able to climb out of the hole at all.

With the uncertainty caused by the coronavirus pandemic and the risk of the virus spreading if tenants are thrown onto the street, the State of Florida will likely enter an order shortly that sets clear precedence for how the landlord/tenant relationship will be handled during this time.

The potential pitfalls created by this virus will hopefully be addressed by an Order put forth from the State of Florida. As always, we will remain apprised to the situation in order to be your source for navigating any changes that happen.

With times of uncertainty come all new ways of protecting your future, and there are many individuals out there who will be receiving a stimulus check that they can put towards oh so many provisions. We want to caution you on planning without speaking with one of our Lead Attorneys: Sophia Dean. She specializes in helping your money go the farthest, to get you in the best situation moving forward.

Depending on what your situations is, there could be two potential uses of your stimulus money. It could be used to provide some relief towards your debt, or it could be used to buy necessities. Of course, without a plan, usually money gets spent; however, we want to encourage you to reach out to us to have a conversation if you’re not sure about the future and how to spend that money.

Below, you will find some ways in which Stimulus Check money will most likely be utilized:

- Basic Needs: This is a time in which you must take care of yourself, and if you absolutely need to spend that money, then supplies are your priority.

- Put It Towards Your Taxes: The government has extended the deadline to pay taxes back to July 15th

- Use it to Strengthen Your Emergency Fund: You can use your check towards making your emergency savings stronger.

- Investing It: Investments, especially in Real Estate, are how individuals find the arbitrage of passive income.

- Lower Your Student Debt: With interest payments suspended, you can make payments towards the premium. Lowering your principal balance could mean smaller interest payments once interest rates are put back into place.

- Paying off debts: If the amount owed in debt is not significant, this might be the right move, but not always.

When it comes to money, we always recommend planning over anything else. Having a focused roadmap to success takes a team, and we are here to help you navigate these uncertain times. For us, we believe that our experiences translate to advantages and victories for you. We want you to utilize the fact that we have encountered many situations, and that every single one has taught us something new. The commonality between them all is that ideas in a vacuum are less powerful than ones formulated using a team. The adage: “Two heads are better than one,” remains true, especially in finance.

So before you pay your debts with your Stimulus Check, consult with us. All it takes is one new conversation, one new plan, and someone that has your best interest in mind and that works within the legal system every single day. That’s us, and we promise that we will do our best to never steer you wrong.

We are consistently here to provide you with information that can help you navigate this difficult time.

Below, we are going to discuss acts that are being expanded.

These laws provide coverage, especially to those who must be out of work due to health-related issues.

Keep in mind that you always want to consult a lawyer about every legal decision, and with things changing by the day, we understand that information is power. Below, we will detail the Emergency Family and Medical Leave Expansion Act, and the potential changes could help you get the most out of your job while staying healthy and protected during the pandemic.

Expanded Coverage and Eligibility – The Act significantly amends and expands FMLA on a temporary basis. The current employee threshold for FMLA coverage would change from only covering employers with 50 or more employees to instead covering those employers with fewer than 500 employees.

It also lowers the eligibility requirement such that any employee who has worked for the employer for at least 30 days before the designated leave may be eligible to receive paid family and medical leave. As a result, thousands of employers not previously subject to the FMLA may be required to provide job-protected leave to employees for a COVID-19 coronavirus-designated reason.

However, the Act now includes language allowing the Secretary of Labor to exclude healthcare providers and emergency responders from the definition of employees.

These occupations are allowed to take such leave. The Act also appears to exempt small businesses with fewer than 50 employees if the required leave would jeopardize the viability of their business.

Reasons for Emergency Leave – Any individual employed by the employer for at least 30 days (before the first day of leave) may take up to 12 weeks of job-protected leave to allow an employee, who is unable to work or telework, to care for the employee’s child (under 18 years of age).

If the child’s school or place of care is closed or the childcare provider is unavailable due to a public health emergency. This is now the only qualifying need for Emergency FMLA and a significant change from the prior version of the bill passed by the House over the weekend, which contained several other COVID-19-related reasons to provide Emergency FMLA.

Paid Leave – Another significant change from the prior version passed from the House is the reduction of the unpaid period of Emergency FMLA. Now, the first ten days (rather than 14 days) of Emergency FMLA may be unpaid.

During these ten days, an employee may elect to substitute any accrued paid leave (like a vacation or sick leave) to cover some or all of the 10-day unpaid period.

After the ten days, the employer generally must pay full-time employees at two-thirds the employee’s regular rate for the number of hours the employee would otherwise be regularly scheduled.

The new Act now limits this pay entitlement to $200 per day and $10,000 in the aggregate per employee.

Calculating Pay for Non-Full Time Employees – Employees who work a part-time or irregular schedule are entitled to be paid based on the average number of hours the employee worked for the six months before taking Emergency FMLA.

Employees who have worked for less than six months before leave are entitled to the employee’s reasonable expectation at the hiring of the average number of hours the employee would generally be scheduled to work.

Job Restoration – Employers with 25 or more employees will have the same obligation as under traditional FMLA to return any employee who has taken Emergency FMLA to the same or equivalent position upon the return to work.

However, employers with fewer than 25 employees are generally excluded from this requirement if the employee’s position no longer exists following the Emergency FMLA leave due to an economic downtown or other circumstances caused by a public health emergency during the period of Emergency FMLA.

This exclusion is subject to the employer making reasonable attempts to return the employee to an equivalent position and requires an employer to make efforts to return the employee to work for up to a year following the employee’s leave.

Effective Date and Expiration – The president signed the legislation on the evening of March 18, which means the leave provisions will go into effect on April 2.

There are different portions of this Act that we will discuss in the future. What does it all mean for you? It means that you could potentially be entitled to benefits that weren’t available before.

As always, if you have questions, we are here to help and disseminate information that may apply to your current situation. Do not hesitate to reach out. We are committed to consistently being your source for knowledge and how the laws are changing to help you.

The Orlando Law Group has summarized the details of the Families First Coronavirus Response Act.

Overview

- President Donald Trump signed an emergency bill on Wednesday, March 18, 2020 to expand family and medical leave. According to various media reports, the bill guarantees paid sick leave for certain U.S. workers, including those employed by private entities or individuals who employ fewer than 500 employees.

- The U.S. Senate passed the bill, titled the Families First Coronavirus Response Act, by a 90-8 vote.

- The bill takes effect April 2, 2020, and it will end on Dec. 31, 2020.

- If you would like to speak to a lawyer about this information, please call The Orlando Law Group at (407) 512-4394.

You can view the details in a downloadable PDF below:

ALERT: Families First Coronavirus Response Act. [PDF]

[Guest Article] Editorial note: This article is written during the coronavirus pandemic of 2020. Many companies are having their employees work from home while coronavirus works its course.

So here you are faced with the option or requirement to start working from home. Whatever the reason, you’ve got a lot of thinking to do. Working from home can be a daunting change of pace for many people.

It’s quite different working from home. There’s a lot of consistency when you work in an office or regular place of business. Not so much at home. Some people live alone, while others have five other humans living with them. It’s fluid and dynamic, and every home has a unique environment and set of distractions.

Hi, I’m Chris, and for the last 20 years, I’ve run an Internet Marketing business. When I lived in New England, I had an office. It was cool, and I liked going there every day. But, after a while, I started working from home, and I found that I could be a thousand times more productive doing so.

That’s when I made the switch to permanently working from home. Over that time, I’ve learned a lot about what it takes to be incredibly productive working in the same place you sleep. So, stick with me here, and I’ll share with you my favorite tips for working from home.

Structure is Critical

There’s no denying that you can easily fall into a non-productivity chasm when you work from home. Distractions are everywhere you turn, and you are literally in the place where you most often chill out.

So, you need to establish some clear structure into your day. Determine what hours you’ll be working, write them down or put them in your calendar or planner and stick to it. When it’s time to work, everything else gets put away.

Focusing on structure and sticking to a schedule will help you mentally transition from being at home to being at work.

There’s also a benefit at the far end of a structured work-from-home workday. That is when your schedule for the day is over, you put the work away, and you resume your non-work activities.

Get Dressed For Work

No kidding on this one. Getting dressed like you are going to work will help you mentally transition into your workday.

Staying in your sweats or that mumu you got from Wish will keep your mind in chill-out mode, and you will more easily become distracted.

So, get in the habit of dressing for work.

Bonus tip: It’s easy to forget to shower when you work from home. Make a point of taking that shower in the morning before you “go to work.” You’ll thank me.

If You Are Doing Video Conferencing

There are few things more frustrating than trying to do a video conference and to have the other party complain that your video keeps freezing.

When it’s time to do that critical video conference, I recommend turning off any other device that might be using your internet connection. Make sure no one is watching Netflix or downloading large files during your call.

Often, I will not rely on my wifi and will instead connect a network cable from my laptop right into my home router to make sure I get the best speed possible.

If You Are Screen Sharing

Screen sharing is commonplace in virtual meetings. If you plan on sharing your screen, it’s a good idea to look at every open program. Make sure that whoever is looking at your screen doesn’t inadvertently see something that might be embarrassing to you, like a browser tab with your favorite K-pop video playing.

Silence!

In my house, there are sometimes four children, my wife, and my dog trying to live their lives while I work. After so many years of doing this, everyone usually works well together when I need quiet time for phone calls. Usually.

Then there are the times when, no matter how nicely I ask, there’s noise. While I don’t have to use this tactic often, there are times when you’ll find me in isolated silence in the back seat of my car. In my garage.

The point here is, you have to be respectful to your clients or co-workers when you are on a call. Sometimes, you have to do whatever it takes.

The First Hour

If I were limited to only giving you a single tip, it would be this one.

The first hour is the “rutter that steers the ship for your entire day.”

When you sit down to work for your first hour, get right to work. And I mean right to work. Stay off social media, don’t check your email, forget Pinterest. Get directly to work for a solid hour.

I even suggest skipping your morning coffee and getting immediately to work for a focused hour. Then, after you bust out an hour of work, break. Make coffee, and get back to work.

Nothing will make you more productive for the rest of the day than powering through as much quality work in the first hour.

If instead, you sit down, sip coffee, and aimlessly scroll through social media, that’s what you’ll end up doing for hours. You’ll lose all steam, and your day will fall into a Facebook abyss.

So, don’t do that. Focus and get to work.

Remember, You Are Not Alone

Many people struggle to get used to working from home. That’s easy to understand. It’s a dramatic change.

Remember, you are not alone. Others are making the same switch and going through the same challenges. Make sure you keep lines of communication open with your co-workers and managers. Let them know how you are feeling and leverage all the resources you have available to make sure your working-from-home is successful.

Christopher Prouty is the founder of NineTwice, a Search Engine Optimization and Search Marketing company. He has clients around the world and has worked from home for over 15 years. He does not own a mumu.

With the Coronavirus, there has come a massive influx of change into our daily lives. Our health is, as always, our top priority. Although the Center for Disease Control is recommending that we take massive precautions, we also must take care of our jobs, routines, and responsibilities without being able to be physically present. Public health officials are recommending that those who are sick stay home. Preventing this virus from spreading has caused so many jobs to be put on pause or to come to a halt. It’s important to know that during this stressful time, we are here to help. It’s important that during this time, we take precautions for those who are at a higher risk.

Even if it’s simply for someone to talk to in case your income gets effected, we believe that conversations with us imbue confidence about the future, which always contains a bit of uncertainty. Consultations are free, and our attorneys go out of their way to consistently be insightful and incredibly helpful. Small businesses have individuals working there that cannot afford sick days, and the businesses themselves can’t afford paid sick leave. The Coronavirus Pandemic is going to have long-term effects on products and services at both the state and local level. The government is doing what they can to brainstorm ways to combat higher rates of job loss and make the federal reserve work to help those who have had a loss of income, but of course, health care costs remain a struggle for those who have lost income due to social distancing and not being able to go to work.

Here in the United States, bankruptcy is not a situation where someone has failed, but rather a situation where someone is beginning to take control. It’s most important to be prepared during uncertain times, and the more ready we are when life happens, the more we can cope with the change. Coronavirus has certainly brought a lot of fear, change, and damage to an economy that benefits from being able to be present at work. Some workplaces can survive using teleconferences and meetings via computer, but others simply cannot. If you have struggled financially because of this virus or have any questions about the future and any, “What if” scenarios, we are always here to help. We care about you and the well-being of the community, and we want to help you stay safe, comfortable, and confident through this difficult time.

Many of our clients have come to us after they’ve gotten behind on payments, and that’s why we want to let you know that it’s never too early to sit down and have a conversation, especially given the fact that you might be out of work and missing some paychecks. Absolutely talk to us before you talk to a debt consolidation company. Many Debt Consolidation Companies will take advantage of the client, placing them in even more debt than they were before. We have seen this happen before.

How has this virus effected your life? We want to know because if there’s an opportunity to help you cope with the change, we will make it happen. The stories that are coming from those we care about are harrowing, and we are committed to our community and to our clients. Even if it’s just to stay connected, do not hesitate to reach out. The ultimate point we want to leave you with is this: don’t let fear or panic stop you from acting. The best knowledge is to be informed by your options. A lot of people, when this happens, start to put their heads in the sand and ignore paperwork and phone calls. It’s best to get on the phone with us as quickly as possible, and together we can help you get to a stable point.

A Landlord’s Perspective

Almost all residential rental agreements are different, and each one should be gone through in detail before being presented to a renter. Rental agreements should not be made from an agreement template or boilerplate and should be tailored to fit the tenant at hand.

We have gathered some information on a few typical clauses found in residential rental agreements that we believe are important to the contract. This is not an exhaustive list of provisions that we recommend in a residential rental agreement.

Liability- Joint and Several

As a landlord, you want your tenants to pay the rent and to be able to collect rent from all of your tenants on or before the due date. You do not want to find yourself in a position where one tenant has paid their portion of the rent while the other tenants have not, and then have to track down the remaining unpaid tenants.

A Joint and Several Liability Clause basically states that every tenant is jointly AND individually responsible for the entire monthly rent amount and any damages to the unit.

This clause will help protect the landlord in a situation where a tenant is claiming that they have paid “their portion” of the rent, and they do not have to pay for the rest of the tenants’ rent.

If you explain this clause to the tenant, it may help influence which people they allow to move into the unit because they will want to live with roommates that they are certain will pay their share of the rent amount.

Use of Premises

In the terms and conditions of a residential rental agreement, you are allowed to restrict the number of people living in the rented unit. This clause will help prevent your rental unit from becoming the local party house, or from a family allowing other family members to move into the residence.

If your agreement to rent is based on a family of four (4), add this clause to state that the premises should be used and occupied by no more than four (4) people.

Every family is going to have a guest come to visit at some point, so you should add wording that allows a guest to remain in the house for a certain amount of time, such as a week, two weeks, or 30 days.

Your clause should state that if the guest remains after that time period, they need to be added as a renter under the agreement, and you can increase the rent amount to reflect the additional person in the unit.

Prevailing Party Attorney’s Fees

Reimbursement of Attorney’s fees is only available when they are included in a contract, or when they are provided for in a state statute. Residential rental agreements are covered by chapter 83 Florida Statutes, Part II. Florida Statute § 83.48 provides for attorney’s fees

For rental agreements in Florida, this statute may cover you regardless of whether it is listed in the contract.

However, it is still wise to list this in the contract for two reasons, (1) the tenant will be put on notice of the ability for the landlord to seek attorney’s fees (and vice versa); (2) there are certain situations such as a lease-option agreement that may turn what you consider to be a residential lease into a contract for sale.

The addition of the attorney’s fees clause in the contract may allow you to collect attorney’s fees in a situation where your “lease” is not governed by Chapter 83 Florida Statutes.

Severability Clause

This clause states that if one portion of the lease is ruled invalid in court, the rest of the lease is still legally binding. In some cases, the court will void a clause because it contradicts a state law or federal law.

Without this clause, a judge might rule an entire lease void because of one unenforceable provision of the lease, even if the rest of the lease could have otherwise been saved.

Access to Premises

During the lease, situations may arise where the landlord needs access to the unit. Florida Statute §83.53 covers a landlord’s access to the premises. Landlords and tenants must adhere to but not limited to the criteria below:

- The tenant must be given notice of at least 12 hours prior to the entry

- Reasonable time for repairs is between the hours of 7:30 a.m. and 8:00 p.m.

- A tenant is not permitted to unreasonably withhold consent from the Landlord to enter the property to inspect the property, make necessary or agreed repairs, decorations, alterations, or improvements.

- The landlord may also enter the dwelling following:

- The explicit written consent of the tenant.

- In case of an emergency.

- If the tenant is absent from the premises for a period of time.

- The tenant cannot prevent a landlord from showing the property purchasers, contractors, or potential tenants if the landlord complies with the notice requirement.

Although this statute provides the landlord with the ability to access the premises, it is wise to list this in the rental agreement because it puts the tenant on notice of this right. When the tenant refuses to allow access, you do not have to cite a statute that the tenant has never read.

This will give you the ability to cite directly to the standard lease and may be enough to convince the tenant to allow you on the premises.

Use of Premises

This clause dictates how the premises are to be used during the rental period. This clause is very broad and should be used to cover all areas of the property, such as swimming pools, decks, garages, sheds, backyards, etc.

This section of the lease may need to be tailored to fit the tenant(s) each time there is a switch. Children in the residence may require certain rules that an elderly person would not.

If the landlord does not wish to have any animals in the rental, this is the section that should state, “NO PETS ALLOWED.” Additionally, Commercial activity, such as a home business, can have many adverse effects on the rental agreement.

In this clause, the landlord should identify whether they will allow any commercial activity to be conducted on the premises.

Sublease(s) and Assignment(s)

Subleasing and/or Assigning a lease is allowed unless it is expressly outlawed in the rental agreement. If it is not outlawed in the lease, then there is a very real possibility that this issue will arise (it may even arise if it is outlawed in the lease).

Some landlords are fine with this because it creates the possibility of easily replacing a tenant, and some landlords even charge a fee for this. However, an assignment or a sublease can also create huge issues if the replacement tenant is not desirable.

This section of the lease should be used to clearly identify the rights (or lack thereof) to subleasing or assigning the agreement.

Conclusion

If you have a rental or are considering renting your property, you should have a residential rental agreement that adequately protects your interests. Do not download a boilerplate form from the internet and assume you are covered especially as the law does change.

Is this cheesy or romantic? Or just another commercially celebrated day? Not necessarily true to any of these factors. Let’s go back to where Valentines originated. February 14th is referred to as a “feast day” honoring two early saints Valentinus(Valentine’s Day).

It is stated on Wikipedia website that, “A written account of Saint Valentine of Rome’s imprisonment for performing weddings for soldiers who were forbidden to marry . . . “Another account and/or legend, Saint Valentine restored sight to the blind daughter of his judge, and he wrote her a letter signed ‘Your Valentine. (Valentine’s Day).

But it is not until the 14th century where Chaucer played the role of courtly love that it gained attention. The 18th century brought about the expression of love by buying flowers and sending greeting cards.

Cupid came into the picture around the 19th century, to spare someone’s love, any one’s love? Yet the most famous may be Apollo and Daphne the story from Greek mythology, that Apollo held an infatuation for Daphne, and to stop Apollo’s stalking of Daphne she turned into a tree. In the present day and age, stalking is sadly connected to unwanted love, but let us keep in mind that Valentine’s Days purpose is to express likeness and love to our friends and family members.

Buy the flowers, candies, and gifts to express your Cupidness to your loved ones and others. Remember though, the expression of love/likeness should not just be a one-day affair, but 356 days out of the year. Write a note, and tell someone how much they mean to you, or better yet, hold their hand and/or pick up the phone (not a text). Do we really need a celebrated day to remind ourselves how much someone means to us? We can do better than this, right? Let me know when you are done celebrating and the honeymoon is over, and dig deep into the effort of a relationship, that my friend shows real love.

Apollo and Daphne, https://en.wikipedia.org/wiki/Apollo_and_Daphne. Accessed 11 February 2020.

Valentine’s Day, https://en.wikipedia.org/wiki/Valentine%27s_Day Accessed 11 February 2020.

Often times, a community association relies on an attorney to assist with the modification of its governing documents, and to provide answers to questions that affect not only the rights of the community association but its members as well.

There are certain documents that must be completed by an attorney, based on the fact that they involve the interpretation of Florida Statutes while requiring a level of legal expertise and a familiarity with the Association’s Articles of Incorporation, Bylaws, Covenants, and Declarations. Further, based on the fact that the officers and directors of an association owe a fiduciary duty to its members, it is important to keep in mind that any document pertaining to their obligations, or the obligations of its members, be drafted properly.

What HOA activities require an attorney?

The following activities are considered the unlicensed practice of law if performed or completed, on behalf of the association, by anyone other than an attorney:

- Drafting a claim of lien;

- Drafting a satisfaction of claim of lien;

- Drafting a Notice of Commencement Form;

- Determining the timing, method, and form of giving notice of meetings;

- Determining the votes necessary for certain actions, which would entail interpretation of certain statutes and rules;

- Answering a community association’s question about the application of law to a matter being considered,

- advising a community association that an action or course of action may not be authorized by law or rule;

- Drafting any document that must comply with Florida law; and

- Drafting the documents required to exercise a community association’s right of approval or first refusal to a sale or lease.

Due to the fact that such actions may affect, impair, or enhance the rights of numerous homeowners and their property interests, an attorney should be the one to draft and advise on them. Allowing anyone other than an attorney to complete these tasks opens up the association to liability, as well as the possibility of Florida Statute violations.

What are some HOA activities that are not considered the unlicensed practice of law?

Based on a Florida Advisory Opinion issued in 1996 and 2015 by the Florida Supreme Court, there are certain documents that can be drafted without the assistance of an attorney. Although this opinion references the actions of a Community Association Manager, the corollary is that it remains applicable to our discussion on HOA board conduct and the conduct of its members. With regard to the actions of non-lawyers, some of the following tasks may be performed:

- A change of registered agent or office for corporation’s forms;

- Annual corporation reports;

- First and second notices of the date of the election;

- Ballots;

- Written notices of the annual meeting;

- Annual meeting or board meeting agendas;

- Affidavits of mailing; and

- Completing a BPR Form 33-032.

If the additions or amendments pertain specifically to clerical matters and do not involve the interpretation of statutes, documents, or providing legal advice, the above-stated actions may be performed by a non-lawyer.

What are some areas of HOA law that remain unclear?

The Courts have deemed the following areas “grey”, therefore depending on your individual circumstances, you may or may not need an attorney to assist with the following:

- Editing a limited proxy form IF the modification involves:

- Filling in the name of the community association,

- Filling in the name and address of the owner,

- Phrasing a yes or no voting question concerning either waiving reserves or waiving the compiled, reviewed or audited financial statements requirement;

- Phrasing a yes or no voting question concerning carryover of excess membership expenses; and

- Phrasing a yes or no voting question concerning the adoption of amendments to the Articles of Incorporation, Bylaws, or condominium docs.

In addition to the Florida Supreme Court Opinions, an Association’s Declaration and Bylaws typically delineate the powers that a board of directors and its officers possess specifically with regards to the amendment of any governing documents. If such language is not included within the Association’s governing documents, an attorney should be consulted in order to determine how they should be amended.

If you have any questions regarding the actions of your homeowners’ association, or if you need assistance with drafting any of the above-stated documents, do not hesitate to contact The Orlando Law Group at 407.512.4394 to schedule a consultation today.

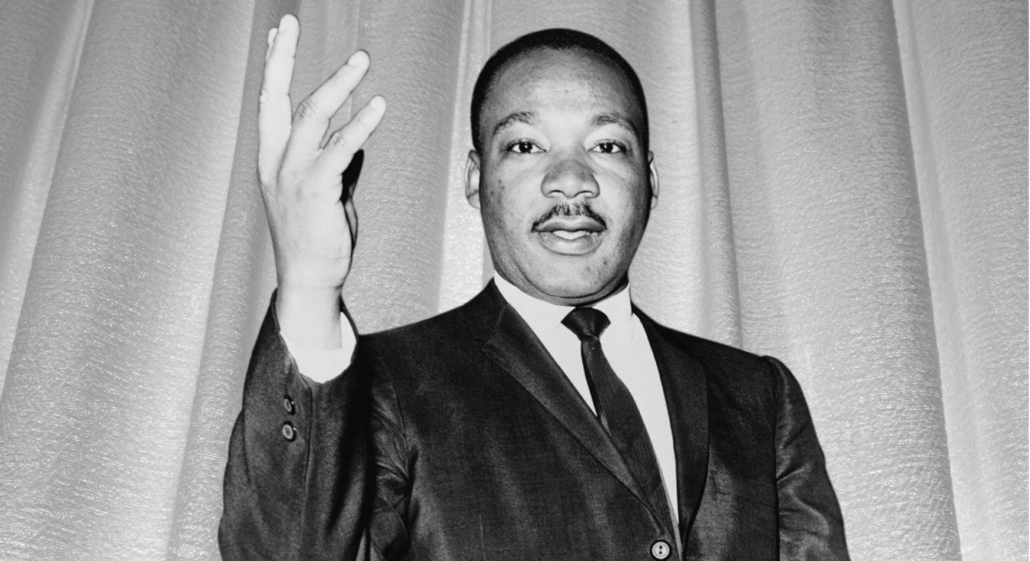

Today we honor the life of Martin Luther King, Jr. MLK gave society an understanding of what it is like to be unheard and treated wrongly in an unfair world. Fifty-two years later, we as a country are still fighting the wars against racism and inhuman acts. In his “Letter from a Birmingham Jail” dated April 16, 1963, Martin Luther King Jr., notes, “Injustice anywhere is a threat to justice everywhere” (2). Do we not recognize injustice in society today, and if we do, why are these acts portrayed at times across our social media, as a show of contentment rather than a show of disgrace? We as individuals are what solidifies us as a nation. Our arms stretch long in unity, but our prides measure shortness. We still fail and fall short of standing up for what is just and at times sit down for what is unjust.

We live in a free society, but when outside individuals try to obtain that same freedom, we fail to provide what our Constitution prevails and as MLK stated, “Anyone who lives inside the United States can never be considered an outsider anywhere in this country” (2). However, not only are the outsiders treated morally wrong, but the insiders of this country as well.

At times laws can become ambiguous, and as individuals we cannot tell the difference between just and unjust laws:

There are just and there are unjust laws. I would agree with

Saint Augustine that ‘An unjust law is no law at all.’ Now

What is the difference between the two? How does one determine

When a law is just or unjust? A just law is a man-made code

That squares with the moral law or the law of God. An unjust

Law is a code that is out of harmony with the moral law. To put

It in the terms of Saint Thomas Aquinas, an unjust law is a

Human law that is not rooted in external and natural law. Any

Law that uplifts human personality is just. Any law that

Degrades human personality is unjust. All segregation statutes

Are unjust because segregation distorts the soul and damages

The personality. It gives the segregator a false sense of

superiority, and the segregated a false sense of inferiority.

(qtd. in Letter from a Birmingham Jail 7)

So, the question posed to you on this day, as we honor MLK is what do you stand for and/or what will you stand up for? Will you stand up against the child that is being bullied by his/her classmates, or the man, woman, and/or child, who is being crucified for their appearance, color, sexual preference, or religious views?

Being quite is never enough to obtain unity and peace for the future.

The Martin Luther King, Jr. Research and Education Institute. Stanford U, 9 Jan. 2020, www.kinginstitute.stanford.edu/king-papers/documents/letter-birmingham-jail. Accessed 9 January 2020.

We love providing you with valuable legal information through the articles in our blog. In 2019 we spent time focusing on the diverse array of legal practice areas we service.

This year, we explored topics ranging from long-standing fields like “personal injury” to relatively new focus areas like “student loan law.” We covered important issues like legalized marijuana, child custody, bullying, mortgages, Uber accidents, and more.

With every article, we keep an eye on readership. We want to know what posts resonate with our audience so we can always be improving.

Based on user engagement, we’d like to share with you the most popular posts from 2019.

What you can do if you think your judge is biased.

When you go to court, you can expect that the judge that is hearing your case is impartial and will fairly treat both sides. While having an unbiased judge is almost exclusively the case, there could be a time where you believe your judge is biased. Read more.

What you need to know about the Lady Bird Deed benefits

What is a Lady Bird Deed, and why is it beneficial? Florida is one of only a handful of states that recognize a Lady Bird Deed. A person who creates a Lady Bird Deed, also known as an Enhanced Life Estate Deed, transfers property to himself for his lifetime. Learn more.

Individualized Education Plan (IEP) and 504 Plan Eligibility in Florida

Depending upon your child’s needs, obtaining the initial Individualized Education Plan or sometimes known as an Individualized education program (IEP) may be a simple process or a little more challenging, depending on specific conditions. Read more.

How to Postpone or Reduce Student Loan Payments

The Student Debt Crisis in Numbers There are various reasons which prevent people from being able to make their student loan payments. As of 2019, Americans collectively owe over $1.56 Trillion in student loan debt. This is spread out by nearly 45 million individuals who are paying back their student loans. Read the full article.

The Effects of Bullying – What You Need to Know

An unfortunate condition in our society is that bullying happens. It happens every day, and the target of the bully are often people who would have never guessed they’d be bullied. The bullies are everywhere; they are children and adults, men, and women. It’s a pervasive aspect of the world in which we live. Read more.

Looking ahead

As we welcome 2020, we’d love to hear from you about topics you’d like us to cover in our blog. Drop us an email with your ideas, and we’ll explore how we can write meaningful and educational content.

Table of Contents

Overview

What is bullying?

Who is at risk of being bullied?

Who is at risk of becoming a bully?

What are the effects of bullying?

How can I stop a bully?

Can a lawyer help if your child is being bullied?

Overview

An unfortunate condition in our society is that bullying happens. It happens every day, and the target of the bully are often people who would have never guessed they’d be bullied. The bullies are everywhere; they are children and adults, men, and women. It’s a pervasive aspect of the world in which we live.

Bullying takes many forms, the types of bullying range from physical bullying to mental abuse to online bullying. Often it’s challenging to pinpoint bullying behavior. Sometimes it is visible, and other times it’s much more subtle.

Bullying happens in many places, including school, church, sport teams, on the internet, the workplace, and in public. Generally, wherever people gather, there’s an opportunity for someone to be bullied.

But what are the effects of bullying? Can it be stopped? What rights does someone who is being bullied have? And, can a lawyer help if you or your child is being bullied?

What is bullying?

There are quite a few definitions of the term. Still, the generally accepted meaning of bullying was created in 2014 by the Department of Health, Center for Disease Control and Department of Education. This definition is federally uniform and was drafted for research and surveillance. In the description, it is cited that bullying includes unwanted aggressive behavior, observed or perceived imbalance of power, and repetition of the behavior or high likelihood of recurrence.

In our common and current language, the definition describes two “modes” of bullying, direct and indirect bullying.

Direct implies that the acts of a bully occur in the presence of a targeted individual. This could be physical and in-person or directly targeted through online channels.

Indirect suggests that the bully is not directly communicating with the targeted individual. A clear example of this is when a bully spreads rumors about a targeted person or child.

Along with the two modes in the definition, there are also four types of bullying, these are categorized as verbal, physical, relational (when an effort is made to cause harm to the relationships or reputation of an individual), and damage to property.

An addition method of aggressive intimidation is called cyberbullying; this occurs when the bully attempts to cause physical, mental, or emotional harm to someone through the use of electronic methods. These attempts of aggression are usually either verbal, threatening through instant messenger, for example, or relational, like spreading rumors through social media. Cyberbullying can also cause damage to property if the outcome of the bullying modifies, deletes, or destroys a targeted individual’s private data that is stored in some electronic method. For example, if someone were to gain access to online image storage and deface or delete the target’s pictures, this would be considered damage to property.

With so many variations and interpretations of the definition, it’s easy to see why many people might be unsure of what is happening to them, or their child is considered bullying. The only sure way to find out would be to speak to someone knowledgeable in the legal implications of the threatening or intimidating acts.

Who is at risk of being bullied?

While people of all ages are bullied, we often hear about children who are bullied in school, sports, church, online, or in some social environment.

When it comes to children and their risk of being bullied, there are some characteristics that we find to be common. Now, as you read this, understand that just because a child might possess one or more of these characteristics, it does not mean that they will be bullied or that they have been bullied. It merely means that there is an increased likelihood that they could be the target of a bully.

Further, many of these characteristics can apply to adults who are maliciously targeted by a bully.

When cases of reported bullying are examined, some of the traits associated with the targets of bullies are:

- Someone who is considered unique or different from their typical peer group. This could be someone who thinks or acts differently or someone who displays physical differences such as being overweight or underweight, wears clothes that are considered “uncool,” wears glasses, or is a standout in some way, like the new kid at school.

- Children and adults who are considered weak or diminutive in some way. These are usually kids who are seen as unable to defend themselves.

- Children with low self-esteem, who are depressed, have mental health issues or display some form of anxiety.

- Children who do not have many or any friends. These are the “loners” in the school population.

- Often children who do not get along with others, have poor social skills, or are seen as irritating are the target of bullying.

While these guidelines suggest who is likely to be a target of a bully, it’s worth noting that there are cases where the subject to aggressive behavior has none of the above characteristics. They might be a popular kid in school who has a lot of friends and high self-esteem, and they are still the target of a bully.

Ultimately, we need guidelines to study a topic, and bullying is no different. But like many different areas of study, so much exists in the gray area that we need to be conscious and aware of the signs of bullying. We might encounter a targeted child who no one thought would be bullied. It’s essential to recognize all victims of bullying.

Now, there are two sides to the concept of bullying. We’ve covered those who are at risk of being bullied. To get a complete picture, we need to consider the risk factors that contribute to someone becoming a bully? Just who among us is more likely to bully others?

Who is at risk of becoming a bully?

Under no circumstances is it right or justified to be a bully. It is crucial, though, for those of us who work hard to stop the bullying to understand what traits are more likely to contribute to someone becoming a bully. By knowing, we have a decided advantage when we work to prevent bullying.

We will also mention here that while we are talking about children who could be bullies, these characteristics could also apply to adults.

We can generally classify children into two distinct groups when we examine the likelihood of them becoming a bully.

The first group is those who are isolated from their peers. Like the bullied, these children are anxious, depressed, have low self-esteem, are less involved in school and social activities, are subject to peer pressure, and cannot quickly identify or empathize with the feelings and emotions of others.

The second group of children is nearly the opposite. They are fashionable and have a large group of friends. They seem to span multiple groups of peers from the more athletic to the academic to the more socially connected. These children are increasingly concerned about their social stance or popularity and like it when they are in control of others, even those in their peer groups.

Some of the factors that indicate a child is more likely to be a bully include:

- They are aggressive among their peers and toward others, including those they might not know very well or others who are outside of their peer group.

- These children are easily frustrated and have a difficult time coping when things do now go exactly their way.

- They have domestic issues or problems at home, including limited or no parental involvement.

- They openly think negatively of others and express those feelings either through thoughts, verbalizations, or actions.

- These children view violence as a positive tactic in dealing with situations.

- They have difficulty following rules or often believe that rules do not apply to them.

It truly is worth repeating that just because a child displays one or more of these behaviors does not mean that they are a bully. No one would ever want to classify a child as a bully when they are, in fact, not one.

What are the effects of bullying?

Sadly, the effects of bullying extend well beyond the individual who is targeted with aggressive behavior. Bullying affects three groups of children and adults. It affects the bullied or the target individual, it affects the bully themselves, and it affects the bystanders, including family, friends, and acquaintances who might have witnessed the abusive acts.

The child being bullied has an increased risk of depression, anxiety, anti-social behavior, and loneliness. They are more likely to lose interest in activities outside of the home and might isolate themselves from their family and friends. In some cases, thoughts or indicators of suicide might exist.

Children being bullied might also experience physical health problems as a result of the stress of the bullying. Further, they may suffer from decreased academic performance.

The child who is bullying also suffers. These children are more likely to abuse alcohol and drugs, engage in promiscuous sexual activity, drop out of school, get in trouble with the law, and isolate themselves from their peers.

Moreover, the bully will often carry their behaviors into adulthood and become bullies in the workplace and at home. They are more likely to engage in abusive relationships with a significant other and their children.

The family, friends, and bystanders who witness the direct or indirect acts or see the after-effects are impacted as well. Children who witness bullying might experience feelings of guilt or regret if they did nothing to stop the aggressive actions. These children are more likely to miss school because they are looking to avoid being bullied or witnessing the bully’s acts again.

How can I stop a bully?

To stop the behavior of bullying, everyone involved needs to take an active role. This includes parents or custodial adults, teachers, school administrators, executives in the workplace, bystanders, and the bullied.

As is the case with so many issues, education and awareness are critical components of preventing and stopping bullying. Everyone involved should be aware of the indicators that someone is at risk of being targeted by a bully or at risk of becoming a bully. Through education, early intervention can happen, and many instances of bullying can be prevented.

Another tactic that can be very effective in preventing bullying is opening the lines of communication between parents, guardians, teachers, school administrators, and children. When people feel comfortable talking about a complicated topic, it eases the difficulty when it is most important to do so. By creating clear channels of accessible communication, instances of bullying that might typically go unreported can be handled quickly and effectively.

Despite these effective tactics, there may still be times when these methods do not stop bullying. It’s during these times that involving a legal professional who focuses on bullying should be a consideration.

Can a lawyer help if your child is being bullied?

Wondering if you can sue a private school for bullying? Give our article a read through, and if you have specific questions you need answered, book a consultation with one of our Personal Injury Lawyers.

When traditional tactics of reporting bullying and communications with school administration and teachers are ineffective in stopping a bully, speaking with an attorney who focuses on bullying is, undoubtedly, an option.

Attorneys who focus on cases that involve bullying are trained to help the bullied children and their families pursue legal action against the schools, churches, organizations, or other parents who are not making attempts to prevent the aggressive acts from happening.

If you believe your child’s school, church, or organization is not actively working to prevent another child from bullying; please contact us to learn what legal options you have.

What is Wholesaling Real Estate?

Investing in real estate is an efficient way to make money and to diversify your investment portfolio. There are many different types of investment strategies that are commonly used to make money in the real estate industry. When people are starting, the difficulty is often “How am I going to invest in real estate if I do not have thousands of dollars saved up?” Wholesaling may provide you with an opportunity to make some money while spending very little out of your pocket.

Wholesaling involves an investor entering into a contract with a homeowner for the purchase of their home, then he or she markets that property to other potential buyers. Once a new buyer is found, the investor will either double close on the property or assign their rights under the contract to the new back-end buyer. The Investor will then keep the profit of the sales (if double closed) or keep an assignment fee charged by the new buyer.

Wholesaling real estate in Florida is a great way to get your foot in the door of the world of real estate investment. Although you may need to have patience, focus on the task at hand and do a good deal of social networking, real estate wholesaling requires little initial financial investment, unlike most other forms of real estate investment. Of all the US states, Florida is a wonderful place to get your start in wholesaling real estate. Investment activity in the state is booming and continues to grow each and every day, meaning that demand for wholesaled properties is also at an all time high. Florida’s growing economy, great labor market, favorable tax policies, and urban areas such as Orlando, Tampa and Miami which have long been attractive investment destinations make Florida a great place to get your start.

The Contract

Once you have found the right property, the objective is to get the seller to agree to the terms of a contract, and to execute said contract. The contract’s contents vary drastically among investors, with each investor incorporating different terms. One fact is for sure, a solid contract is necessary to protect your interests. Using a typical FARBAR contract gives the parties warranties and responsibilities/liabilities that many investors do not want to be incorporated into their wholesale contracts. There is not a one-size-fits-all contract. Investors should be prepared to modify their contract as needed for each deal.

Determining the Price

Investors often have a difficult time trying to determine the price point where they need to be in the contract. If you have a bad price point for your wholesale deal, you will lock down the seller’s property for weeks or months and will be unable to complete the deal with a back–end buyer. The most common way to determine the price point needed for an effective wholesale deal is to use the “70% of ARV rule.” ARV stands for “After Repair Value,” and this value is what the house would be expected to sell for if sold to a retail buyer after all necessary repairs have been made. The general rule of thumb is that an investor who is flipping a house needs to be in a deal with an expected 30% return. This figure also provides a buffer for the investor in case repair costs or other fees run higher than were estimated. To calculate your offer based on the above formula, you take the ARV and multiply this number by 70%. From that result, subtract out the expected repair cost of the property. The remaining figure is the highest amount of money you should offer to the seller. As an example, we will use a house with an ARV of $100,000.00 and an expected repair cost of $20,000.00:

($100,000.00 x .70)= $70,000.00

$70,000 – $20,000.00= $50,000.00.

In order to fix and flip this house, the investor would ideally need to get this property under contract at $50,000.00. Cutting the margins any shorter may lead to a loss on the flip, although it can be done. For a wholesaler, in order for you to find a back-end buyer, you will need to offer them this property at or as close to the $50,000 figure. If the wholesaler can get the property under contract for $45,000, they can assign that contract to a flipper and easily make a $5,000 assignment fee. The shorter you cut the margins, the harder it will be to find a back-end buyer.

Assignment vs. Double Close

An assignment occurs when a wholesaler gets a property under contract, then finds a new buyer. The wholesaler and the new buyer execute an assignment agreement in which the back-end buyer replaces the wholesaler under the original contract. Accompanying this agreement, the back-end buyer tenders a non-refundable assignment fee to the wholesaler. A double closing is two closings. The wholesaler closes on the property with the seller, then immediately sells that property to the new buyer. Typically, the wholesaler will negotiate and contract with the back-end buyer to have as much of the closing costs as possible paid on their behalf. Whether to assign a deal or double close on a deal is typically dependent on the facts of the individual deal. An assignment is often preferred because the investor will have fewer overhead expenses since they do not have to close on the deal. Doing a double closing may also benefit the wholesaler if they are making a lot of money on the deal because the seller will not know how much money the wholesaler is making off of the back-end buyer.

Wholesaling Real Estate, Is It Right For You?

The idea behind wholesaling is that the wholesaler is the middleman between the seller and the back-end buyer. In most cases, the houses contracted for are off-market properties, so the wholesaler is actually finding the property and relieving the back-end buyer of this responsibility. For this service, the wholesaler charges a fee, typically as an assignment fee. Wholesaling has received a bad rap because many people will nickel and dime the sellers, who are often disadvantaged in some way or another, in an attempt to make the most profit possible. Wholesaling provides a great source of income, and it is a good way to keep properties cycling. The profits can also be dumped back into the marketing budget to drum up more properties. It is possible to wholesale ethically if you take the time to learn the process and reach an agreement with the seller that is beneficial to both of you.

This blog does not cover all of the intricacies involved in a real estate transaction, but it should serve a good starting point for your ventures. If you would like to know more about wholesaling, The Orlando Law Group, PL has knowledgeable real estate attorneys to help you navigate the process.

Real estate is an essential part of the Florida economy. Whether you are a large developer or simply buying a home, you need real estate counsel. The Orlando Law Group’s attorneys handle virtually all aspects of real estate. We represent individuals by reviewing their leases as well as contracts. We also represent developers, contractors, lenders, and owners of commercial properties.

The attorneys at The Orlando Law Group represent property owners, prospective property owners, developers, contractors, lenders, investors, real estate agents, brokers, landlords, tenants and more throughout Orlando, Waterford Lakes, Altamonte Springs, Winter Garden, Lake Nona, St. Cloud, Kissimmee, and throughout central Florida.

At The Orlando Law Group, you can be sure that your attorney possesses both a sharp, experienced legal mind, and a friendly smile that will welcome and comfort you. What’s more, we are serious about preventative legal tactics, working to solve issues for our clients before they blow up into legal messes. Simply put, we are here for you, and we have your back at all times!

If you are dealing with a real estate issue or looking for some preventative real estate legal services, please reach out to our office at 407-512-4394, fill out our online contact form.

If you have questions about anything discussed in this article or other legal matters, give our office a call at 407-512-4394 or fill out our online contact form to schedule a consultation. We have an office conveniently located at 12301 Lake Underhill Rd, Suite 213, Orlando, FL 32828, as well as offices in Seminole, Osceola and West Orange counties to assist you.

The Fair Labor Standards Act (FLSA) establishes a minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees in the private sector and Federal, State, and local governments. Unless you fit into an exemption, the Fair Labor Standards Act (FLSA) requires virtually all employers to pay employees at least the federal minimum wage for each hour worked and to pay overtime for all hours worked more than 40 in a workweek. Non-exempt employees are entitled to overtime pay, while exempt employees are not.

Most employees covered by the FLSA are non-exempt. Whether employees are exempt or non-exempt depends on (a) how much they are paid, (b) how they are paid, and (c) what kind of work they do. With few exceptions, to be exempt, an employee must (a) be paid at least $23,600 per year ($455 per week), (b) be paid on a salary basis, and (c) perform exempt job duties. Most employees must meet all three “tests” to be exempt from the FLSA. This blog is only regarding the FLSA pending changes. Keep in mind that this discussion is limited to rights under the FLSA changes. Exempt employees may have rights under other laws or by way of employment policies or contracts that exist outside of the scope of the FLSA.

On September 24, 2019, the Department of Labor reached a final rule that will increase minimum salary requirements for the administrative, professional, and executive exemptions from $23,600 per year ($455 per week), to $35,568 annually ($684 per week). This rule is set to take effect on January 1, 2020. For currently exempt employees, if you are making less than $35,568.00 annually, under the new changes, you would be a non-exempt employee. This means that you are entitled to overtime hours, even if you are a salaried employee. Non-exempt employees are entitled under the FLSA to time and one-half their “regular rate” of pay for each hour they actually work over the threshold in the applicable work period (Usually 40 hours).

Under the new rule, employers can satisfy up to 10% the annual payment threshold through bonuses, incentive payments, and commissions for exempt employees, but the other 90% of the threshold must be paid at a regular rate equal to $615.60 per week. The FLSA changes allow for the employer to make a final catch up payment within one pay period of the end of the year if the employee’s compensation has not reached the required level. If the employer chooses and properly prepares for this option, they are only required to pay their employees 90% of the required salary level ($615.60) per week. At the end of the year, the employees paid-out salary plus bonuses, incentive payments, and commissions do not equal at least $35,568.00 annually; the employer would have to make up the difference within one pay period. After this one pay period, the employer would be in violation of the FLSA regarding exempt employees if they have not paid at least $35,568.00 annually.

If you are an employer, it would be wise to review the status of your employees to determine whether your exempt employees are properly classified under the new rules. If your previously exempt employees were making less than $35,568.00, they will no longer be exempt, and you will be required to pay overtime at time and a half for every hour worked over 40 hours. Reevaluating your employees would also help determine whether reclassifying an employee is a financially wise decision. If the employee does not meet the threshold for exempt status and rarely works overtime, it might be a better decision to reclassify that employee as non-exempt instead of raising their salary by more than $10,000.00. On the other hand, if an employee who works regular overtime is close to the exempt salary threshold, it may be wise to increase their salary to save money on the overtime.

The FLSA is a complex system of laws regulating most employer/employee relationships. If you are unfamiliar with the FLSA and what impacts it may have on your business, do not hesitate to contact a lawyer. The Orlando Law Group, PL is ready to help with all of your employment needs.

By Attorney Sophia Dean

The Student Debt Crisis in Numbers

Out of this increasingly large group, there are, of course, individuals who will find themselves in circumstances which will prevent them from making their payments. These people are not alone. In fact, there are roughly 3.7 million student loans in deferment and 2.6 million in forbearance. The good news is that there are deferment and forbearance options which can alleviate some of this stress and allow you to get back on stable ground.

What to Know About Deferments and Forbearances

While there are several options for individuals who are experiencing difficulty paying back their student loans, like income-based repayment, we commonly see deferments and forbearances. On the surface, these options may seem similar, but they actually have several differences which can make them more or less suitable for certain situations. Both allow you to temporarily stop making federal student loan payments or temporarily reduce the amount you pay.

A key reason to look into these options is to help to avoid defaulting on your loans, which can cause significant consequences.

Based on the type of loan you took out, your interest may accrue during this time. Because this will add to the total cost of the loan, it is important to be clear about these details. It is also important to make sure that you have completed the steps necessary to attain an active deferment or forbearance so you don’t miss payments and negatively affect your credit score.

The important question is, Which choice is right for you?

What are the Differences Between Deferments and Forbearances?

The most important thing to know about deferments and forbearances is that they are not one and the same.

A Deferment can be an excellent solution for people experiencing certain circumstances. On particular loans, you may not be responsible for paying the interest that accrues during this period.

Your lender or loan servicer may offer different deferment options based on your particular situation. For example, federal loans have the following deferment options:

● Economic Hardship Deferment

● Graduate Fellowship Deferment

● In-School Deferment

● Military Service and Post-Active Duty Student Deferment

● Parent PLUS Borrower Deferment

● Rehabilitation Training Deferment

● Temporary Total Disability Deferment

● Unemployment Deferment

A Forbearance is a period during which your monthly loan payments are temporarily suspended or reduced. If your particular situation includes financial hardship that prevents you from making loan payments even though you are willing, your lender may grant you a forbearance. During this period of time, the principal payments are postponed. The one caveat is that interest continues to accrue.

You could potentially qualify for a forbearance if you are temporarily unable to make scheduled monthly payments for the reasons listed below:

● Financial difficulties

● Medical expenses

● Change in employment

● Other reasons acceptable to your loan servicer

Because the loans continue to accrue interest during the forbearance term, it is smart to continue paying at least the monthly interest. This method is helpful as it resolves any delinquency on the account.

There are also two different kinds of forbearance—General and Mandatory.

Also known as a “discretionary forbearance”, a general forbearance can be requested due to financial difficulties, medical expenses, change in employment, and/or other reasons acceptable to your loan servicer. It is at the discretion of the loan servicer whether to honor this request or not, hence the name. These can be granted for periods of no longer than 12 months but can be requested again when this time expires.

Mandatory forbearances MUST be honored by loan servicers as long as the individual meets the eligibility criteria. There are more options for eligibility for mandatory forbearances and each one has more specific qualifications and stipulations attached, but the major requirements are;

● If you are serving in a medical or dental internship or residency program

● If you are participating in a teaching service which would qualify you for teacher loan forgiveness

● If the amount owed on your student loan is equal to or greater than 20% of your total monthly income

● If you qualify for partial repayment of your loans under the Department of Defense Student Loan Forgiveness program

● If you are a recently activated member of the national guard but are not eligible for military deferment

As with discretionary forbearances, a mandatory forbearance is granted for a maximum of 12 months. However, this may be extended as long as you continue to meet the eligibility requirements.

Postpone or Reduce Student Loan Payments Next Steps–How to Seek Out a Deferment or Forbearance

Both deferments and forbearances are excellent options for people struggling to pay their student loans due to temporary financial hardships. However, if your financial woes are likely to continue for an extended period of time, it may be a better option to change to an income-driven repayment plan. These are based on your discretionary income, size of your family and multiple other factors. If your loan is not repaid after 20-25 years, you may also qualify for student loan forgiveness as well.

If your circumstances are likely to improve within a reasonable amount of time, it would be a good idea to consider a deferment or forbearance. It is important to remember that your loan servicer does not work for you. The best course of action is to use an outside source such as a well-versed attorney with expertise the variety of student loan options. They will assist you in deciding if a deferment or forbearance is the most applicable in your individual case. Having someone to trust can drastically help reduce the stress and worry associated with dealing with student loan debt.

For the past ten years, The Orlando Law Group has earned a reputation as the Orlando-area law firm that cares about its clients and the communities it serves. Offices located in Waterford Lakes, Altamonte, Lake Nona, and Winter Garden. For more information, visit www.TheOrlandoLawGroup.com.

The Orlando Law Group Welcomes Another Excellent Attorney

Orlando, FL (September 6, 2019) – The Orlando Law Group is proud to announce the addition of attorney M. Florence King to the firm. King brings a plethora of leadership, along with 15 years of experience working predominantly within the community association industry.

A graduate of Ave Maria School of Law in 2005, Ms. King spent the early years of her career working for Park Square Enterprises, gaining experience in title closings and land acquisition. After the Great Recession of 2008, she took an opportunity with Larsen & Associates, P.L., a small, local community association law firm in need of managing their unplanned growth in association collection matters. King, who’s unique background also includes accounting and computer programming, helped innovate and automate several processes, leading that firm towards becoming a top performing association law firm in Central Florida.

King was drawn to The Orlando Law Group’s dedication and commitment to the people and communities they serve. She believes these principles and values should serve as the backbone of doing community association law with a renewed dedication to the homeowners within those associations.

“Community association legal representation oftentimes brings an adversarial atmosphere to communities,” said King. “I think it can be done better. I think the real win is in fostering a mutual bond amongst the homeowners within the community where everyone properly understands the benefits of abiding by the rules and regulations, and how abiding by those rules and regulations helps create a powerful, common vision for the community where property values increase, community harmony is enhanced, and homeowners can obtain a genuine sense of pride for the place they call home.”

While King’s experience will enhance the firm’s community association representation, she is looking forward to diversifying her legal practice. “I’m passionate about serving people,” said King. “I’m thrilled to be given an opportunity to work with a firm that is founded on that same value, and I’m looking forward to utilizing my education and experience to enhance the lives of others through the practice of law.”

For the past ten years, The Orlando Law Group has earned a reputation as the Orlando-area law firm that cares about its clients and the communities it serves. Offices located in Waterford Lakes, Altamonte, Lake Nona, and Winter Garden. For more information, visit www.TheOrlandoLawGroup.com.

A reverse mortgage is a loan available to homeowners aged 62 years or older that allows a homeowner to borrow against the equity they have in their house in the form of a lump sum, fixed monthly payment, or line of credit.

Unlike a typical mortgage, with a reverse mortgage, the bank pays the owner of the house monthly mortgage payments, and when the owner of the house passes away or chooses to sell the home, the entire reverse mortgage balance becomes due and payable.

As long as the borrower is 62 years of age or older and lives in the home, he or she is not required to make any monthly payments towards the loan balance. The concept of the reverse mortgage originated as a way to help retirees with limited income use and benefit from the equity which they have built up for their house without having to sell the property.

With these types of mortgages, the owner of the property is ultimately responsible for the property taxes, homeowners’ insurance premium, utilities, fuel, maintenance, and other common household expenses. If only one spouse signed the loan paperwork, in certain situations, the other spouse may continue to live in the home even after their spouse passes away if he or she continues paying the above-noted bills and maintains the property. However, since the other spouse was not a part of the loan, all payments under the reverse mortgage will cease.

Most reverse mortgages have a “non-recourse” clause, which means that the value of the reverse mortgage cannot exceed the value of the home when the loan becomes due and payable. This can be beneficial upon the death of the homeowner because there will not be any bills related to the reverse mortgage outside of the equity in the house.

No other assets in the estate of the deceased homeowner are affected. There are three different types of reverse mortgages. As with any type of transaction, it is important to shop around for the best option for your home and fully understand the complexities of the transaction before locking yourself into a long-term loan.

Single-Purpose Reverse Mortgage

With this type of mortgage, homeowners can use single-purpose reverse mortgage proceeds only to pay for specific items that are approved by the lender. This single purpose may be for necessary repairs and maintenance, or payment of property taxes. The lender on this type of file is a state, local, or non-profit agencies. This type of mortgage considered the least expensive type of reverse mortgage. This option can be beneficial to many homeowners because it offers fewer expenses and fees than other types of reverse mortgages.

Home Equity Conversion Mortgage

This type of mortgage is likely to be more expensive and is the most widely used version of the reverse mortgage. This is because there are no income requirements, and the proceeds from the loan can be used for any purpose. This loan does not carry the same single-purpose limit detailed above.

The Home Equity Conversion Mortgage, or HECM, is insured by the Federal Housing Administration, or FHA, which means it has loan limits and some additional guidelines in place to protect borrowers. The HECM loan limit, or maximum claim amount, for 2022 is $970,800. That means the highest home value that can be used to calculate your reverse mortgage proceeds is $970,800.00.

Counseling is typically required before applying for this loan due to the higher expenses, interest rates, and payback requirements of this loan. Because this is a federally insured mortgage, there are usually high up-front or monthly ongoing insurance payments. These payments are usually taken out of the loan itself, and reduces the amount you are able to borrow.

Proprietary Reverse Mortgages

A proprietary reverse mortgage is not available to the average homeowner. As of 2022, in order to qualify for this type of reverse mortgage, your home must have a value of at least $970,800.00. This is not a federally insured mortgage and often has less stringent insurance requirements.

If you are considering this type of loan, you should also apply for the Home Equity Conversion Mortgage. This way, you can compare fees for both types of reverse mortgages to find out which loan fits better for your situation.

Wrapping It Up